Role of central banks as governments and inflation regain prominence in the economy

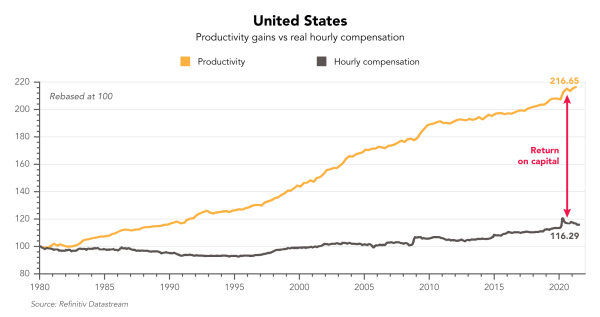

Various brakes have been applied to the growth potential of the leading economies: unfavourable demographics with an ageing population, high public-sector indebtedness and stalling productivity gains. Widening inequalities also represent a hurdle. The solutions under consideration potentially signal the end of the neo-liberal Reagan/Thatcher era, together with higher inflation.

Gianluca Tarolli, Chief Economist and Strategist, co-CIO

Investments in the environmental transition, aimed also at boosting productivity, rank at the top of politicians’ agendas. Similarly, reducing the inequalities that have built up over recent decades is now not just a social but also an economic imperative, affecting China as well as G7 countries.

Investments in the environmental transition, aimed also at boosting productivity, rank at the top of politicians’ agendas. Similarly, reducing the inequalities that have built up over recent decades is now not just a social but also an economic imperative, affecting China as well as G7 countries.

Grasping the inequality issue, which has slowed long-term growth, marks a departure from the Anglosphere’s treasured neoliberalism, which has prevailed since the 1980s. It also means stronger government intervention in the economy, with colossal spending in prospect. Governments will also need to make selective tax increases to achieve their targets and safeguard their reputations. In other words, ‘whatever it takes’ will no longer be the guiding ethos.

After the quicker-than-expected rebound in the global economy, several countries have already roared back to pre-pandemic levels (China, of course, but also the US and Switzerland). Although we think the global economic growth will slow in 2022, business trends still look healthy from the current vantage point and in any case should be above-potential. Despite higher energy and, more broadly, commodity prices, consumer spending looks set to remain on an upward track thanks to lower unemployment as well as surplus household savings. Yet investment, from both public and private sources, will be the crucial forces driving the economy, just as European and US recovery funds start working their magic. Such an environment will be conducive to wage increases, as demands for a salary uplift gain traction, and this will tend to nudge prices higher.

EXPERT VIEW

Central banks’ new mantras

Charles Wyplosz // professor emeritus, graduate institute of international and development studies

Interest rates are at last set for lift-off in 2022, having been pinned at the lowest tolerable levels for a decade. Although central banks are not saying so yet, and investors are acting as if they believe the ‘transitory’ message, inflation is likely to hold up above 2%. But will central banks really have the willpower to risk undermining public debt, unsettling markets and jeopardising the economic recovery? The answer: they have no choice. Combating inflation is their core directive. For central banks it makes sense to raise interest rates – slowly if possible, swiftly if necessary – without rushing to cut the size of their balance sheets. Halting their asset purchases (or QE, to use central bank jargon) means leaving in place the massive liquidity pools, which play a key stabilising role. If markets start to sway, central banks can still pump in more cash wherever the tension builds up. Their key mission is not to underpin share or property prices, which are merely conduits of monetary policy as far as the rate-setters are concerned. Besides, if inflation is a threat, putting share prices under pressure by hiking interest rates is one means of putting the brakes on an overheating economy. The real challenge will be to find the right dose to curb inflation without nipping the recovery in the bud. Where fiscal policies remain expansionary, that will be all the more feasible, e.g. in the US. The debate has not yet begun in Europe but is likely to be problematic. As for the SNB, it would be delighted to follow suit.

Interest rates are at last set for lift-off in 2022, having been pinned at the lowest tolerable levels for a decade. Although central banks are not saying so yet, and investors are acting as if they believe the ‘transitory’ message, inflation is likely to hold up above 2%. But will central banks really have the willpower to risk undermining public debt, unsettling markets and jeopardising the economic recovery? The answer: they have no choice. Combating inflation is their core directive. For central banks it makes sense to raise interest rates – slowly if possible, swiftly if necessary – without rushing to cut the size of their balance sheets. Halting their asset purchases (or QE, to use central bank jargon) means leaving in place the massive liquidity pools, which play a key stabilising role. If markets start to sway, central banks can still pump in more cash wherever the tension builds up. Their key mission is not to underpin share or property prices, which are merely conduits of monetary policy as far as the rate-setters are concerned. Besides, if inflation is a threat, putting share prices under pressure by hiking interest rates is one means of putting the brakes on an overheating economy. The real challenge will be to find the right dose to curb inflation without nipping the recovery in the bud. Where fiscal policies remain expansionary, that will be all the more feasible, e.g. in the US. The debate has not yet begun in Europe but is likely to be problematic. As for the SNB, it would be delighted to follow suit.

It’s the same old story. Whenever a major change occurs, we start by citing all kinds of unlikely reasons to persuade ourselves the present situation won’t last. Inflation will no longer be what it once was… and the central banks will respond.

Dans la même catégorie

Related

En la misma categoria

In der gleichen Kategorie

- Perspectives

- Allocation d’actifs

- Allocation d’actifs

- Allocation d’actifs

- Allocation d’actifs

- Gianluca Tarolli, Chef économiste & stratégiste / co-CIO

- Perspectives

- Économie, état et inflation

- Économie, état et inflation

- Économie, état et inflation

- Économie, état et inflation

- Gianluca Tarolli, Chef économiste & stratégiste / co-CIO

- Charles Wyplosz, Professeur émérite, Institut de Hautes études Internationales et du Développement

- Perspectives

- Asset allocation

- Insights

- Asset allocation

- Asset allocation

- Asset allocation

- Gianluca Tarolli, Chief Economist and Strategist, co-CIO