Some corners of the bond market are still attractive

Adrien Letellier, Analyst – Debt and Credit

Investors everywhere are on the look-out for alternative sources of yield to offset paltry interest rates. In our market scenario, three segments stand out: hybrid corporate debt, ‘rising star’ issuers and Chinese sovereign debt, each of which has its own features and role to play within portfolios.

Investors everywhere are on the look-out for alternative sources of yield to offset paltry interest rates. In our market scenario, three segments stand out: hybrid corporate debt, ‘rising star’ issuers and Chinese sovereign debt, each of which has its own features and role to play within portfolios.

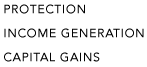

Hybrid debt – a halfway house between equity and debt – provides a useful way to obtain returns close to high-yield paper, from investment-grade names. For this subordinated debt, the risk of default is equivalent to that on the same issuer’s senior bonds; and in current conditions, investors are on average securing a fourfold higher return from hybrid relative to senior debt. We believe that this segment will not only galvanise returns in 2022 but also provide an extra hedge against the prospective bounce in sovereign yields.

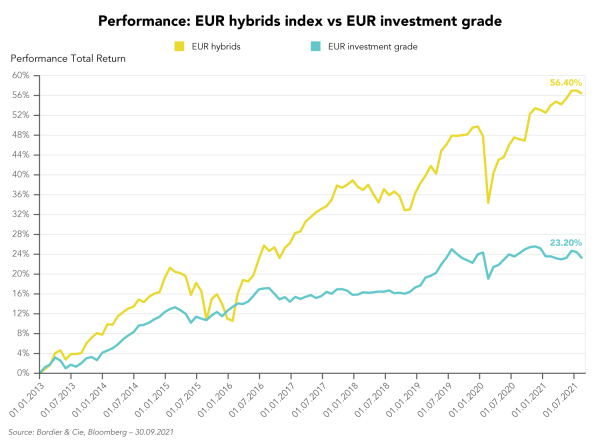

Rising stars is another segment attracting attention. These are issuers currently rated as ‘high yield’ but whose financial trajectory places them on course to return to the investment-grade fold within two years.

In 2020, the pandemic fuelled a record number of downgrades from investment grade to the high yield category. But the subsequent economic upswing is nursing companies’ balance sheets back to health, while the uptrend in their business this year is set to continue into 2022. Accordingly, countless so-called ‘high yield’ companies are set to regain their investment-grade status, resulting in a lower credit risk and capital gains for those holding these bonds.

The key for investors is to be ‘long’ these rising stars before the rating agencies upgrade the debt. The data shows that 100% of the capital performance is chalked up in the 12 months preceding the upgrade and renewed inclusion in investment-grade indices. Combined with the usual coupons, this performance factor secures superior gains for investors.

Chinese sovereign bonds

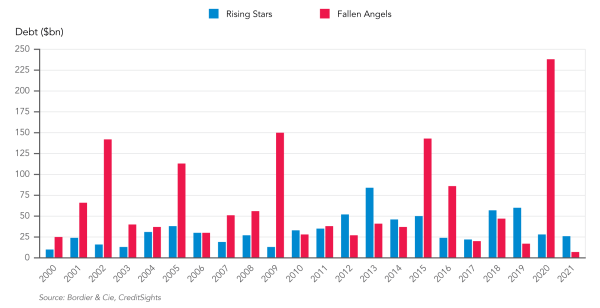

The Chinese bond market continues to open up thanks to increasing inclusion of its bonds in global indices. China’s sovereign bonds are denominated in local currency and offer an attractive risk-reward profile. They are highly rated (AA+), while the country’s increasing international reach is also lifting the currency.

At the same time, the five-year yield is currently close to 3%, which is streets ahead of the yields on developed economies’ bonds. We therefore think that this segment will in 2022 provide a useful means of boosting returns and shielding against rising rates in the rest of the world.

other income sources: uncorrelated structured products

Quentin Denys - Investment Advisor

Securing decent returns while keeping risk in check has become harder. Helpfully, structured products can be used to create an alternative source of yield that is uncorrelated with equity and bond markets. Among the several product categories, here are the solutions that we believe are the right ones for 2022:

Securing decent returns while keeping risk in check has become harder. Helpfully, structured products can be used to create an alternative source of yield that is uncorrelated with equity and bond markets. Among the several product categories, here are the solutions that we believe are the right ones for 2022:

- Dispersion products, which extract gains from performance differentials within a very carefully selected basket of stocks. Regardless of where the market is heading, performance dispersion is the criterion generating the return.

- Arbitrage products with full capital protection, which aim to extract gains from the spread between future and spot prices on a variety of asset classes, irrespective of whether prices are rising or falling.

- Systematic strategies, which use decision rules to take human error and market timing out of the equation when investing.

So as we can see, structured products offer a host of solutions for enhancing portfolio returns, resilience and diversification.