Superior growth prospects provided by megatrends

In our view, three main themes will shape the economy and produce superior growth relative to other business segments: the transition, digitalisation and wellness. These megatrends also offer opportunities for investors.

Frédéric Potelle, Research director, co-cio

Transition requires shift from ESG to impact investing. Government authorities, public opinion and society at large have now grasped the importance of environmental priorities. The imperative of taking action rapidly is understood; and there is a clear resolve to embark on an energy and environmental transition that will keep global warming at bay.

Transition requires shift from ESG to impact investing. Government authorities, public opinion and society at large have now grasped the importance of environmental priorities. The imperative of taking action rapidly is understood; and there is a clear resolve to embark on an energy and environmental transition that will keep global warming at bay.

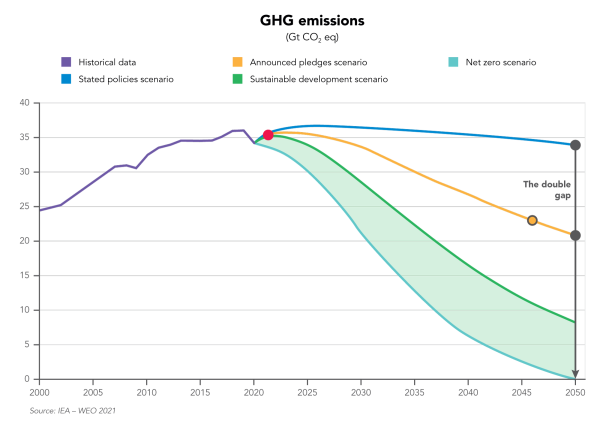

The problem is that the commitments given by governments to date are not enough to keep the economy on a trajectory for an increase of +1.5°C, or at most +2.0°C, in average temperatures by 2100, compared with the pre-industrial era. In fact, nobody is really ‘walking the talk’. We truly believe that the political and social pressure will turn up the heat in 2022, in the aftermath of the upcoming COP26 in November this year, which will manifest the need to take urgent action more keenly than ever.

Current public policies fall way short of the undertakings by each country, which were already lacking relative to the 2050 targets.

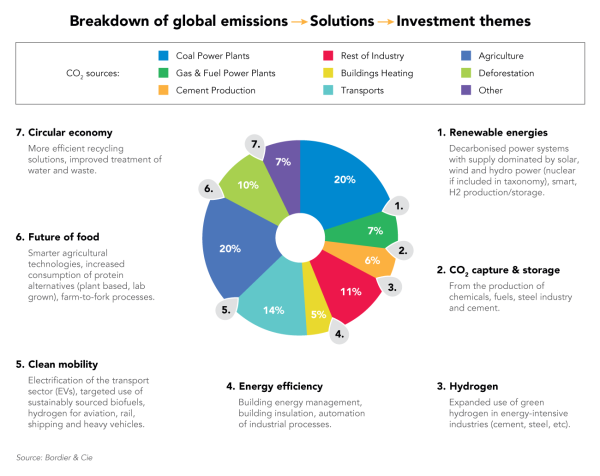

The requisite investments for the global economy’s energy transition, currently estimated at $140,000 billion out to 2050 (equating to over 5% of global GDP), will also continue to rise. Based on a rational approach, we have endeavoured to quantify the sources of global carbon emissions by type of activity and to model likely changes, as well as the technologies involved and the businesses with the expertise needed to develop the vital new solutions. This is encompassed in the shift from ‘ESG’ to ‘impact’ investing. While the energy transition is often depicted in the media as being essentially a power generation issue, thereby bringing solar and wind power to the fore, our approach bears in mind that almost three-quarters of carbon emissions stem from other sources.

In practice, there are seven key themes, each with its own ecosystem, actors and interdependencies. And each offers opportunities to invest in equities and green/climate bonds, which are now awarded labels (which is why we have partnered with the Climate Bond Initiative).

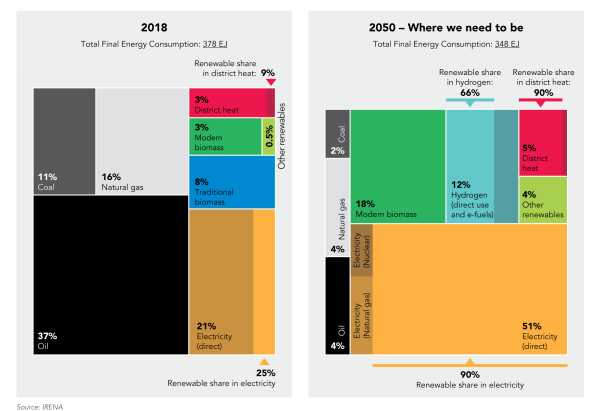

Crucially, while power generation accounts for just one-quarter of the problem, electricity provides a large part of the solution. Through transport, industry and thanks to storage solutions (such as hydrogen), the electrification of the economy is going to speed up.

No transition is possible without commodities

Commodities will play a key role in leading this transition. According to the International Energy Agency, demand for ‘clean’ technologies could quadruple by 2040. The problem is that investments in the mining sector were halved between 2012 and 2020, which now sets the scene for extreme pricing pressures and potentially a new ‘bull market’ in 2022. Copper – a pivotal metal for the transition – provides a prime illustration. Prices have surged with the upturn in investments in so-called greenfield projects, which carry higher risks. While supply is set to grow, this may take time and the scale of the increase is still unknown. More broadly, growth in the commodities sector, though set to remain cyclical, is gaining a structural aspect.

Dans la même catégorie

Related

En la misma categoria

In der gleichen Kategorie

- Mégatendances

- Transition

- Transition

- Transition

- Transition

- Frédéric Potelle, Directeur de la Recherche & co-CIO

- Mégatendances

- Digitalisation

- Digitalisation

- Digitalisation

- Digitalisation

- Mendon Qestaj, Analyste média, technologie, télécommunications

- Mégatendances

- Bien-être

- Bien-être

- Bien-être

- Bien-être

- Agathe Bouché Berton, Analyste matières premières, chimie, santé

- Mégatendances

- Digitalisation

- Megatrends

- Digitalisation

- Digitalisation

- Digitalisation

- Mendon Qestaj, analyst – media, technology, telecoms

- Mégatendances

- Wellness

- Megatrends

- Wellness

- Wellness

- Wellness

- Agathe Bouché Berton, Analyst – Commodities, Chemicals, Healthcare