hedge funds are back

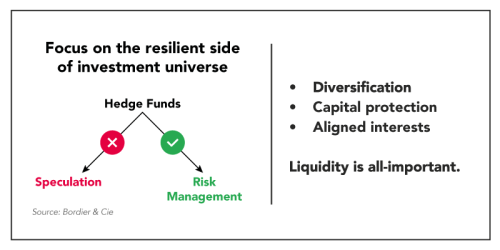

The new-look volatility conditions are positive for hedge funds. Rather than using it for speculative purposes, we see this asset class as an effective risk management and diversification tool. In a nutshell, hedge funds are an alternative source of return that also shield portfolios.

Rafaël Anchisi, Head of Multi-Manager Hedge Fund Selection

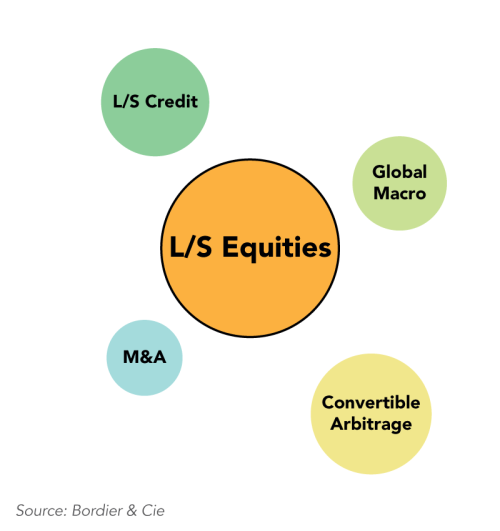

In recent years, a more volatile market backdrop has once again sparked positive performances from hedge funds. Looking ahead to 2022, amid higher volatility and more demanding multiples, we have established positions in market-neutral or sophisticated investment approaches, or sometimes both at the same time.

In recent years, a more volatile market backdrop has once again sparked positive performances from hedge funds. Looking ahead to 2022, amid higher volatility and more demanding multiples, we have established positions in market-neutral or sophisticated investment approaches, or sometimes both at the same time.

Put another way, within each of these broad classifications, our goal is to find strategies with low equity exposure that stand to gain from increased dispersion within markets. At the same time, more directional approaches are also the focus, but we will only invest in resilient hedge funds whose loss-of-principal risk is rigorously and continually managed. Market volatility is what reconciles these two aims that at first glance seem at odds with each other. We are giving priority to equity-market strategies while not overlooking other opportunities, again for purposes of diversification.

Dans la même catégorie

Related

En la misma categoria

In der gleichen Kategorie

- Protection

- Or et options put

- Or et options put

- Or et options put

- Or et options put

- Gianluca Tarolli, Chef économiste & stratégiste / co-CIO

- Protection

- Hedge funds

- Hedge funds

- Hedge funds

- Hedge funds

- Rafaël Anchisi, Responsable sélection fonds

- Protection

- Gold and put options

- Protection

- Gold and put options

- Gold and put options

- Gold and put options

- Gianluca Tarolli, Chief Economist and Strategist, co-CIO